Ethereum Network – Scaling problems that have been sporadically affecting the Ethereum network have resurfaced. While bulls and bears were battling it out in the markets, the Ethereum blockchain was fighting to restore some semblance of normal service. The congestion forced a number of exchanges to halt withdrawals, with one going so far as to advise customers to use a different cryptocurrency.

Also read: Despite Regulations, One South Korean Crypto Exchange Rises to the Global Top

Ethereum Enters the Slow Lane

Over the last couple of months, the Ethereum network has reported record activity, peaking at over one million transactions a day. This growth has come at a price in the form of slow or backlogged transactions, causing fees to reach record highs and ICO participants to miss out on token sales after failing to push their ether through in time. On Wednesday January 17, two exchanges reported ethereum withdrawal issues that were affecting users.

First up was Bitstamp, which noted that there were ETH withdrawal delays, before updating the situation four hours later to say the matter had been resolved. Users of Kucoin exchange have been more significantly affected on account of ethereum withdrawal delays that have dragged on for days. The exchange posted the following notice on Wednesday, including a novel suggestion: that users withdraw in neo instead of ether. This suggestion is unlikely to have been of much help to users who needed their ETH to interact with the ethereum ecosystem.

More Gas, More Money, More Problems

Following the notice, Kucoin followed up with a blog post containing a form to be filled in by users who were still waiting for their ethereum withdrawals to be processed. A week prior, the exchange had explained that ETHwithdrawals were subject to delays as they were being released at four-hour intervals. Not everyone has been convinced by Kucoin’s decision to lay the blame on the Ethereum network though, with some users pointing out that the exchange’s ETH withdrawal fees are five times higher than on other sites, which seem to be processing transactions just fine.

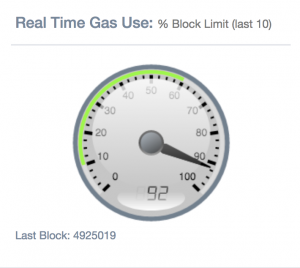

What is beyond dispute is that numerous exchanges have encountered similar problems of late, with Bittrex reporting only a week ago: “Due to incredibly high gas prices, we’re preventing new ETH and asset deposit addresses from being created. Existing deposit addresses will work as normal.”

Eth Gas Station currently reports fast transactions as requiring 51 gwei, or around $0.93 to process. The web is awash with crypto projects promising that their new blockchain can handle a gazillion transactions a second. The reality, however, is that if these networks were ever to be stress tested in the wild like Ethereum or Bitcoin, they would face the exact same same problems. Scaling blockchains while preserving decentralization is even harder than it sounds.

Do you think scaling problems are inevitable as blockchains become busier? Let us know in the comments section below.